This report presents a comprehensive analysis of Apple's unofficial presence in the Russian market after its formal exit in March 2022. Despite the official cessation of sales, the analysis reveals the existence of a large and lucrative "phantom market" consisting of two key components: gray imports of physical products and continued revenue from software services.

I. Summary

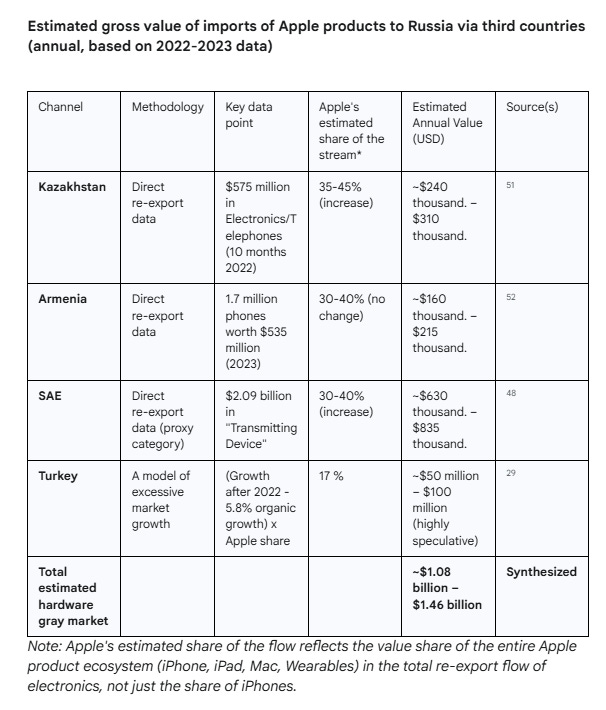

The estimated annual value of the hardware gray market, i.e. Apple products illegally imported into Russia, after taking into account the entire product portfolio (including Mac computers, iPad tablets and wearable electronics) ranges from $1.08 billion to $1.46 billion. This flow is primarily supplied through sophisticated re-export channels through third countries. Key hubs in this network are the United Arab Emirates (UAE), which acts as a major financial and logistics hub, followed by Kazakhstan and Armenia, which serve as crucial land bridges. Turkey plays a more complex role, more as a logistical and financial intermediary than as a direct source of products.

In addition to hardware, Apple continues to generate significant revenue from its active device base in Russia. An estimated 35.2 million active iPhones in the country generate annual revenue from services (App Store, iCloud, Apple Music, etc.) of approx. 1.21 billion USD. These high-margin revenues represent a passive rent for the company that flows without the need for an official presence or operating costs in Russia.

The total value of Apple's unofficial Russian market - a combination of gray hardware and digital services - is thus estimated at approx $2.5 billion annually. This conclusion underscores a crucial finding: Apple's official withdrawal from Russia has not eliminated demand or halted related economic activity. Instead, he transformed the market and created a complex ecosystem of parallel imports that continues to satisfy strong and sustained demand for premium Apple products from Russian consumers while providing the company with ongoing and highly profitable revenue.

II. Pre-War Benchmark: Apple's Official Footprint in Russia (2019-2021)

To accurately assess the extent of the current gray market, it is essential to first establish a clear and data-driven baseline of the performance of Apple and the broader smartphone market in Russia and key transit countries prior to the invasion in February 2022. This benchmark serves as a reference point to identify anomalous growth post-2022 that signals re-export activities.

Official performance of Apple in Russia

Before its exit from the market, Apple's Russian subsidiary, Apple Rus LLC, had a strong and growing performance. Its revenues have grown steadily: from 189.3 billion rubles in 2019, they increased by an impressive 40.7% to 266.3 billion rubles in 2020, reaching a record high of 386 billion rubles in 2021.26 Using the average exchange rate for 2021, which was approximately 73.8 rubles per USD 1, the sales for the year 2021 correspond approximately

5.23 billion USD.

This financial success was also supported by record sales of pieces. In 2021, Apple delivered more than 4.5 million iPhones to Russia.26 This gave the company a market share of 14% in terms of units sold (up from 11% in 2020), but more importantly, a dominant 36% market share in terms of revenue.27 This disparity clearly shows the strength of the Apple brand in the premium segment, where the average selling price of its products significantly exceeded the competition.28

The emergence of a "premium demand vacuum"

Apple's official exit in 2022 has not removed the strong and growing demand for its premium products in Russia; on the contrary, it created a "premium demand vacuum". Pre-war figures showing a 36% share of sales from a mere 14% share of units sold demonstrate the existence of a large and wealthy consumer group disproportionately concentrated on Apple products.27 This was not a general demand for smartphones, but a specific, brand-loyal demand for high-end Apple devices. When Apple officially left the market, this specific, high-spending consumer base was left without an official supply channel. This pre-existing, inelastic demand for premium goods is the primary economic force that has made the creation of extensive channels of parallel imports not only possible, but highly profitable and inevitable. It wasn't a phone replacement, but a replacement

iPhone. This vacuum acted as a powerful magnet that began to attract products from neighboring countries.

Pre-war markets in transit countries

For later analysis, it is crucial to establish the natural rate of growth in markets that later became re-export hubs:

Turkey: Turkey's smartphone market was valued at USD 5.93 billion in 2024, with a projected compound annual growth rate (CAGR) of 5.8% until 2030.29 We will use this figure of 5.8% as the "natural growth rate" for Turkey. Apple's market share in the pre-war period was around 17-20%.31

Kazakhstan: The smartphone market here saw a 6.7% growth in units sold in 2020, reaching 4.3 million units.33 Apple was considered a "relatively small player" in terms of pieces before the war, although data suggests a significant iOS presence.31 We estimate the natural growth rate to be 6-7%.

Armenia: The internet penetration rate here increased by 5.6% between 2020 and 2021.35 Apple's market share was substantial, hovering around 26-27% in early 2021.36 We estimate the natural growth rate to be 5-6% in line with digital adoption trends.

III. Parallel Import Apparatus: Channels and Mechanisms

The emergence and expansion of the gray market for Apple products in Russia was not spontaneous, but was made possible by a combination of targeted legislative changes and strong economic incentives.

Legal framework and logistics networks

A fundamental step was taken by the Russian Ministry of Industry and Trade (MinPromTorg) in May 2022, when it legalized the so-called "parallel import". This mechanism allows businesses to import goods without the consent of the trademark owner, effectively providing a legal basis for the gray market.37 The list of approved goods included products that accounted for 36% of total Russian imports by value in 2021.37

In response, sophisticated logistics networks quickly formed. These networks include smaller firms and trading houses in third countries such as Turkey, the UAE, Kazakhstan and Armenia, which legally purchase goods and then re-export them to Russia.37 The scale of these operations is enormous; between May and December 2022 alone, the volume of goods imported through parallel imports exceeded USD 20 billion.37

Price analysis and arbitrage opportunity

The economic engine of this system is price arbitrage – the difference between the purchase price in the transit country and the selling price on the Russian gray market. The following table compares the prices of the base model iPhone 15 (128 GB) and illustrates the profit potential for re-exporters.

Differences in "Mushroom Effectiveness"

A price comparison reveals significant differences in the "efficiency" of individual re-export centers. While Turkey shows the highest potential premium, its extremely high domestic prices make it more of a final consumer market than an efficient hub for professional traders. The price of an iPhone in Turkey is even higher than in the Russian gray market, which means that a trader would lose money by buying in Turkey and selling in Russia.40 This indicates that the goods are flowing

over Turkey to Russia is probably not purchased in the Turkish domestic market, but passes through the country in transit or through special trade agreements.

Conversely, the UAE and Armenia, with prices close to the US base, are much more attractive as source points for large-scale re-export operations. Low Local Surcharge in UAE (Price ~$817) 42 making them an ideal place to buy large quantities of goods which are then shipped to Russia to take advantage of the massive price differential there. The price in Armenia is even lower, making it another prime sourcing center.47 Kazakhstan is in the middle with its price, indicating that it can serve as both an end market and a transit point. Thus, the analysis must distinguish between the growth of a country's domestic market and its role as a transit/resource center. The UAE's value lies not in the growth of its own consumers, but in its role as a low-cost logistics and financial intermediary for the Russian market, as confirmed by direct evidence of the UAE-Russia electronics trade.48

IV. Analysis of key re-export corridors

After the introduction of sanctions, several main corridors were created through which Apple products flow to Russia. Each of these channels has its own specifics and different degrees of verifiability.

A. The Turkish Channel

Turkey represents a complex but important link in the re-export chain. Although direct data on the re-export of smartphones is limited, the country was specifically warned by the United States about its role and subsequently suspended the export of some items with military potential to Russia.49 Extremely high domestic iPhone prices 44 suggest that parallel imports to Russia do not come from Turkish retail outlets. It is more likely that Turkey acts as a logistical and financial intermediary rather than a direct source of products. Its role may be to provide corporate structures or financial services for traders who buy goods elsewhere (for example in the UAE) and then transport them to Russia.

B. Kazakh bridge

The Kazakhstan channel is extremely well documented and represents one of the clearest evidences of massive parallel imports. Data shows explosive growth:

In the first half of 2022, Kazakhstan's mobile phone exports to Russia rose from just 611 units (worth $40,600) in 2021 to 199,900 pieces in value $79.9 million.50 This represents an approximately 327-fold increase in number of pieces and an almost 2,000-fold increase in value.

In the first ten months of 2022, the combined exports of electronics and mobile phones exceeded 575 million USD, which is an 18-fold increase over the previous year.51

These numbers are so dramatic and product category specific that they provide conclusive evidence of the existence of a massive re-export pipeline. This is not an estimate based on market growth, but direct evidence of trade diversion. The scale suggests a highly organized, industrialized operation.

C. Armenian Gate

Armenia's role is similarly transparent, and the data confirms its key position. In 2023, Armenia exported 1.7 million mobile phones in total value 535 million USD. Reports explicitly state that these phones were primarily imported from countries like Vietnam and then re-exported to Russia.52 This volume represented a doubling from 2022. The impact is also visible in tax revenues: leading electronics retailers in Armenia saw their tax levies double to triple in 2023.53 The Armenian data, especially the mention of imports from Vietnam, reveals the global nature of the supply chain that supplies the Russian gray market. It is not just a diversion of American or European stocks; it is a global purchasing effort that is channeled through these Caucasian hubs.

D. Center in United Arab Emirates

The UAE has been identified as a critical, high-value hub for re-exports. Analysis of trade data shows that the top export item from UAE to Russia in 2022/2023 was “Broadcasting Equipment” with a staggering value 2.09 billion USD.48 This Harmonized System (HS Code) category is a well-known channel for high-end electronics, including smartphones. This is also confirmed by reports that the UAE is a center for the re-export of electronics to Russia 38 and their general role as a re-export leader, with approximately 25% of their annual demand for 3.5 million mobile phones being re-exported.54

The UAE functions as the most sophisticated and financially significant hub. Unlike Armenia or Kazakhstan, which primarily serve as land bridges, the UAE uses its world-class logistics (ports, air cargo) and advanced financial services to facilitate the highest value transactions. The figure of $2.09 billion indicates a range that far exceeds other channels. Low taxes and minimal surcharges on electronics like iPhones 42, making the UAE the most profitable place for

purchase goods intended for re-export. The UAE thus likely acts as the primary purchasing and financial center for the entire operation, from where goods are shipped either directly to Russia or potentially to other hubs such as Armenia or Kazakhstan for final land transit. They are the "brain" of the operation, while the others can be seen as the "arteries".

V. Extended Product Portfolio Analysis and Impact on Estimation

The original analysis focused mainly on iPhones, which are the most significant product by volume, but represent only a part of the overall Apple ecosystem. To refine the estimate, it is necessary to take into account other high-value categories such as Mac computers, iPad tablets and wearable electronics (Apple Watch, AirPods), which are also subject to gray imports.

Tablety (iPad): Before exiting the market, Apple had a strong position in the Russian tablet market. In 2023, it still held a share of around 10.8%.63 In monetary terms, Apple was even the market leader, which confirms the premium nature of its products.63 Globally, the iPad had a share of approximately 34.6% in 2021, indicating its dominant position.64

Computers (Mac/MacBook): Similar to tablets, in the segment of computers and laptops, Apple focuses on the premium segment. Although it was not the absolute leader in the number of units sold, it was among the top 3 brands in sales in Russia.65 Apple's global market share in the PC segment was around 7.9% in 2021.66

Wearables: In the category of wearable electronics, especially smart watches, Apple had a dominant position in Europe in 2021 with a share of over 35%.67 In Russia, its share was estimated at 7% in pieces in 2024, which still ranks it among the key players.68

Including these categories in the analysis strengthens the original assumption. Flows of goods declared as "electronics" or "broadcasting equipment" (eg from the UAE and Kazakhstan) do not only include iPhones. These other, often very expensive, Apple products are also included in them. Due to their high price and strong demand in the premium segment, it is justified to increase the estimate valuable Apple's share of these mixed flows. The original estimate, based on iPhone dominance alone, was conservative; a comprehensive view of the entire portfolio justifies a slight increase in the estimated percentages.

VI. Quantifying the hardware gray market

Based on the analysis of individual re-export corridors and after taking into account the broader product portfolio, an adjusted estimate of the total value of Apple products flowing to the Russian market can be compiled.

The methodology remains the same, but a key assumption — "Apple's Estimated Stream Share" — is adjusted upward for general categories to reflect the value of not only iPhones, but also Macs, iPads and other accessories. This share is estimated based on Apple's dominant position in the premium segment of the Russian market before the war (36% of smartphone sales) and a strong position in other categories.63

Based on this adjusted synthesis, the total annual value of the gray market for Apple hardware in Russia is estimated to be approx 1.27 billion USD (the mean value of the estimated range).

VII. Digital Echo: An Estimate of Apple's Continuing Services Revenue

Apple's exit from the Russian hardware market did not mean the interruption of its most profitable revenue streams. The company continues to generate significant revenue from services provided on the existing base of active iPhones in Russia. This income represents a "phantom rent" that flows with almost zero operating costs.

The calculation of this income takes place in four steps:

1. Calculation of the active base of iPhones in Russia:

There are 130.4 million Internet users in Russia.56 The share of the iOS operating system in the Russian mobile device market is consistently around 27%.57

Calculation: 130.4 million internet users x 27% iOS share = ~35.2 million active iPhones in Russia. This is a conservative estimate that provides a solid basis for further calculations.

2. Calculation of global average revenue per user (ARPU) from services:

Apple's worldwide service revenue will reach $96.2 billion in fiscal 2024.59 There are approximately 1.4 billion iPhones in active use worldwide.60

Global ARPU from services (per iPhone): 96.2 billion. USD/1.4 billion iPhonu˚=∼$68.7 na aktivnıˊ iPhone rocˇneˇ.

3. ARPU adjustment for the Russian market:

Global ARPU cannot be directly applied to the Russian market. It needs to be adjusted downwards to take into account several factors:

Payment restrictions: Sanctions have made it more difficult for Russian users to pay for services in the App Store.

Unavailability of services: Some western apps and services are blocked or pulled from the market.

Lower purchasing power: Russia's GDP per capita is lower than Apple's primary Western markets.

Based on these factors, a conservative discount factor of 40-60% is applied.Adjusted ARPU for Russia: $68.7×(1−0.5)=∼$34.35 per active iPhone.

4. Calculation of total estimated annual revenue from services from Russia:

Calculation: 35.2 million active iPhones × $34.35 adjusted ARPU = ~$1.21 billion per year.

The hardware business, while large, has gross margins of around 37%, while the services segment has margins of nearly 74%.59 So it is twice as profitable for every dollar of sales. While the hardware gray market does not generate any direct revenue for Apple (profits are split between re-exporters and retailers), each iPhone sold this way becomes a potential long-term source of high-margin service revenue once activated. Thus, the gray market inadvertently functions as an unpaid customer acquisition channel for Apple's most profitable segment of the business.

VIII. Final Analysis: The Scope and Implications of Apple's Russian Gray Market

The synthesis of all the findings makes it possible to formulate a conclusion about the overall extent of Apple's unofficial market in Russia and to evaluate its wider implications.

Total market value

Combining the adjusted estimated value of the hardware gray market (median value ~$1.27 billion) and estimated annual service revenue (~$1.21 billion), we arrive at a total unofficial market value of approx. $2.5 billion annually. This amount represents the total economic activity associated with Apple products and services in Russia after the company's official exit.

Implications of the analysis

For Apple: The company is in a strategic paradox. Although it has formally complied with the sanctions and stopped official sales, it continues to passively and profitably profit from the Russian market. The gray market ensures that its ecosystem remains dominant in the premium segment and prevents competitors from taking over its user base.

For sanctions regimes: The analysis demonstrates the permeability of product-oriented sanctions in a globalized economy. Sophisticated actors can easily create bypass routes through willing or opportunistic third countries.37 The focus of law enforcement may need to shift from pure export bans to targeting the financial and logistical networks that facilitate this trade.38

For intermediary states: Countries such as Kazakhstan, Armenia and the UAE have seen significant economic benefits from re-exports.51 This creates an economic dependency that can complicate their geopolitical direction and lead to reluctance to act against this lucrative trade despite international pressure.51

Future Outlook: The sustainability of these channels depends on their profitability (price arbitrage) and the level of enforcement of sanctions by the West. As long as the demand vacuum persists in Russia and economic incentives remain strong, these phantom markets are likely to adapt and persist. Apple's story in Russia is thus a powerful case study in the resilience of brand loyalty, the limits of sanctions and the complex dance of global trade in a fragmented geopolitical environment.

Prepared by: Strategic Analysis and Industry Research Team

Date: July 9, 2025

Methodological note on currency conversion

To ensure accurate comparisons over time, all historical financial data is converted to US dollars (USD) using the average annual exchange rate for the year in question. This approach standardizes the data and eliminates the distorting effects of currency fluctuations. For current product prices, the most recent spot rate is used, which is specified. Relevant exchange rate data comes from sources.1

Works Cited

Exchange Rate Average (US Dollar, Russian Ruble), as of July 9, 2025, https://www.x-rates.com/average/?from=USD&to=RUB&amount=1&year=2021

US Dollar to Russian Ruble Exchange Rate - Real-Time & Hist… - YCharts, accessed July 9, 2025, https://ycharts.com/indicators/us_dollar_to_russian_ruble_exchange_rate

US dollar to Russian rubles Exchange Rate History | Currency Converter - Wise, accessed July 9, 2025, https://wise.com/gb/currency-converter/usd-to-rub-rate/history

Russian Ruble - Quote - Chart - Historical Data - News - Trading Economics, accessed July 9, 2025, https://tradingeconomics.com/russia/currency

US Dollar to Russian Ruble Exchange Rate Chart - Xe, accessed July 9, 2025, https://www.xe.com/currencycharts/?from=USD&to=RUB

Turkey Exchange Rate against USD, 1957 – 2023 | CEIC Data, accessed July 9, 2025, https://www.ceicdata.com/en/indicator/turkey/exchange-rate-against-usd

Exchange Rate Average (US Dollar, Turkish Lira), used July 9, 2025, https://www.x-rates.com/average/?from=USD&to=TRY&amount=1&year=2023

US dollar to Turkish lira Exchange Rate History | Currency Converter - Wise, accessed July 9, 2025, https://wise.com/gb/currency-converter/usd-to-try-rate/history

TRY Historical Exchange Rates (Turkish Lira), applied July 9, 2025, https://www.x-rates.com/historical/?from=TRY&amount=1&date=2023-12-31

Turkish lira to US dollars Exchange Rate History | Currency Converter - Wise, accessed July 9, 2025, https://wise.com/us/currency-converter/try-to-usd-rate/history

Exchange Rate Average (US Dollar, Kazakhstani Tenge), used July 9, 2025, https://www.x-rates.com/average/?from=USD&to=KZT&amount=1&year=2023

Kazakhstan Exchange Rate against USD, 1993 – 2023 | CEIC Data, accessed July 9, 2025, https://www.ceicdata.com/en/indicator/kazakhstan/exchange-rate-against-usd

Kazakhstan Exchange Rate (KZT per USD, eop) - FocusEconomics, accessed July 9, 2025, https://www.focus-economics.com/country-indicator/kazakhstan/exchange-rate/

US dollar to Kazakhstani tenge Exchange Rate History | Currency Converter - Wise, accessed July 9, 2025, https://wise.com/gb/currency-converter/usd-to-kzt-rate/history

Kazakhstani tenge to US dollars Exchange Rate History | Currency Converter - Wise, accessed July 9, 2025, https://wise.com/us/currency-converter/kzt-to-usd-rate/history

Exchange Rates and Real Effective Exchange Rates - Armenia - CEIC, accessed July 9, 2025, https://www.ceicdata.com/en/armenia/exchange-rates-and-real-effective-exchange-rates

Armenia Exchange Rate against USD, 1992 – 2023 | CEIC Data, accessed July 9, 2025, https://www.ceicdata.com/en/indicator/armenia/exchange-rate-against-usd

US dollar to Armenian drams Exchange Rate History | Currency Converter - Wise, accessed July 9, 2025, https://wise.com/gb/currency-converter/usd-to-amd-rate/history

USDAMD US Dollar Armenian Dram - Currency Exchange Rate Live Price Chart, accessed July 9, 2025, https://tradingeconomics.com/usdamd:cur

USD AMD | US Dollar Armenian Dram - Investing.com, accessed July 9, 2025, https://www.investing.com/currencies/usd-amd

United Arab Emirates Exchange Rate against USD, 1966 – 2023 | CEIC Data, accessed July 9, 2025, https://www.ceicdata.com/en/indicator/united-arab-emirates/exchange-rate-against-usd

Exchange Rate Average (US Dollar, Emirati Dirham) - X-Rates, accessed July 9, 2025, https://www.x-rates.com/average/?from=USD&to=AED&amount=1&year=2023

US dollar to United Arab Emirates dirhams Exchange Rate History | Currency Converter, accessed July 9, 2025, https://wise.com/gb/currency-converter/usd-to-aed-rate/history

USD AED Historical Data - Investing.com, accessed July 9, 2025, https://www.investing.com/currencies/usd-aed-historical-data

United Arab Emirates dirham to US dollars Exchange Rate History | Currency Converter, accessed July 9, 2025, https://wise.com/gb/currency-converter/aed-to-usd-rate/history

Apple`s financial performance in Russia - TAdviser, accessed July 9, 2025, https://tadviser.com/index.php/Article:Apple%60s_financial_performance_in_Russia

While all will change in 2022, Apple grew their iPhone market share in Russia in 2021 by being the top 5G brand and top Revenue maker, použito července 9, 2025, https://www.patentlyapple.com/2022/03/while-all-will-change-in-2022-apple-grew-their-iphone-market-share-in-russia-in-2021-by-being-the-top-5g-brand-and-top-reven.html

Smartphones (Russian market) - TAdviser, accessed July 9, 2025, https://tadviser.com/index.php/Article:Smartphones_(Russian_market)

Turkey Smartphone Market by Region, Competition, Forecast & Opportunities, 2020-2030F, accessed July 9, 2025, https://www.researchandmarkets.com/reports/5647258/turkey-smartphone-market-by-region-competition

Turkey Smartphone Market Size, Share and Trends Report 2030F - TechSci Research, accessed July 9, 2025, https://www.techsciresearch.com/report/turkey-smartphone-market/11744.html

iPhone Market Share by Country 2025 - World Population Review, accessed July 9, 2025, https://worldpopulationreview.com/country-rankings/iphone-market-share-by-country

49+ Smartphone Usage Statistics, Facts, and Trends [2025] - Passport-Photo.Online, accessed July 9, 2025, https://passport-photo.online/blog/smartphone-usage-statistics/

Smartphones (Kazakhstan market) - TAdviser, accessed July 9, 2025, https://tadviser.com/index.php/Article:Smartphones_(Kazakhstan_market)

Mobile & Device Vendor Market Share Kazakhstan | Statcounter Global Stats, accessed July 9, 2025, https://gs.statcounter.com/vendor-market-share/mobile-device/kazakhstan/2021

Digital in Armenia: All the Statistics You Need in 2021 - DataReportal, accessed July 9, 2025, https://datareportal.com/reports/digital-2021-armenia

Samsung, Apple dominate mobile vendor marketshare in Armenia, with Xiaomi catching up fast - The Armenian Observer Blog, použito července 9, 2025, https://ditord.com/2021/03/samsung-apple-dominate-mobile-vendor-marketshare-in-armenia-with-xiaomi-catching-up-fast/

Managing sanctions risks from Russia's trade partners, accessed July 9, 2025, https://www.controlrisks.com/our-thinking/insights/managing-sanctions-risks-from-russias-trade-partners

As Russia Completes Transition to a Full War Economy, Treasury Takes Sweeping Aim at Foundational Financial Infrastructure and Access to Third Country Support - U.S. Embassy In Nicaragua, použito července 9, 2025, https://ni.usembassy.gov/as-russia-completes-transition-to-a-full-war-economy/

iPhone Unlocked Phones - Best Buy, used July 9, 2025, https://www.bestbuy.com/site/iphone/iphone-unlocked-phones/pcmcat1542305802014.c?id=pcmcat1542305802014

Apple's iPhone 15 Sold in Russia Despite Sanctions - VOA, accessed July 9, 2025, https://www.voanews.com/a/fact-check-apple-s-iphone-15-sold-in-russia-despite-sanctions-/7280412.html

How much is an iPhone 14PM in Russia right know? You can get it from a normal retail store or you need to find it from stores that buy them from other countries? : r/AskARussian - Reddit, použito července 9, 2025, https://www.reddit.com/r/AskARussian/comments/z6ohmz/how_much_is_an_iphone_14pm_in_russia_right_know/

Buy iPhone 15 128GB Black - Apple (AE), used July 9, 2025, https://www.apple.com/ae/shop/buy-iphone/iphone-15/6.1-inch-display-128gb-black

Buy iPhone 15 and iPhone 15 Plus - Apple (AE), used July 9, 2025, https://www.apple.com/ae/shop/buy-iphone/iphone-15

New iPhone 15 prices in Turkey, including taxes - Alanyabrand, used July 9, 2025, https://alanyabrand.ru/en/article/tseny-na-novye-iphone-15-v-turtsii-vklyuchaya-nalogi

iPhone 15 128 GB Prices, Features and Reviews | Cheapest Akakçe, použito července 9, 2025,https://www.akakce.com/cep-telefonu/en-ucuz-iphone-15-fiyati,1745758198.html

Smartphones iPhone 15 - buy smartphones iPhone 15 in Almaty, Kazakhstan at a low price | online store https://www.technodom.kz, použito července 9, 2025,https://www.technodom.kz/catalog/smartfony-i-gadzhety/smartfony-i-telefony/smartfony/f/cl-smartphones-main-spec-292/iphone-15

Iphone 15 128GB (Black) - 3D Planet, used July 9, 2025, https://3dplanet.am/en/product/iphone-15-128gb-black/

Russia (RUS) and United Arab Emirates (ARE) Trade | The Observatory of Economic Complexity, accessed July 9, 2025, https://oec.world/en/profile/bilateral-country/rus/partner/are

Turkey limits exports to Russia as BRICS nations call for alternative international payment system to US dollar, použito července 9, 2025, https://www.export.org.uk/insights/trade-news/turkey-limits-exports-to-russia-as-brics-nations-call-for-alternative-international-payment-system-to-us-dollar/

Kazakhstan increases manifold its re-export to Russia — - 22.08 ..., accessed July 9, 2025, https://kz.kursiv.media/en/2022-08-22/kazakhstan-increases-manyfold-its-re-export-to-russia/

Just Passing Through: Kazakhstan's Parallel Trade Predicament ..., accessed July 9, 2025, https://thediplomat.com/2023/02/just-passing-through-kazakhstans-parallel-trade-predicament/

Armenia's Growing Re-exports: Gold, Diamonds, Mobile Phones ..., accessed July 9, 2025, https://www.thecaliforniacourier.com/armenias-growing-re-exports-gold-diamonds-mobile-phones-top-the-list/

Armenia Reports Surge In Tax Revenue From Re-Exporters - Azatutyun Radio station, used July 9, 2025, https://www.azatutyun.am/a/32523099.html

UAE a rising hub for reexport of mobile phones - Exporter Today, accessed July 9, 2025, https://exportertoday.co.nz/news/uae-rising-hub-reexport-mobile-phones

Turkey Mobile Phones Market Summary, Competitive Analysis and Forecast to 2027, accessed July 9, 2025, https://www.researchandmarkets.com/reports/5834905/turkey-mobile-phones-market-summary-competitive

Digital 2024: The Russian Federation - DataReportal, accessed July 9, 2025, https://datareportal.com/reports/digital-2024-russian-federation

Mobile Vendor Market Share Russian Federation | Statcounter Global Stats, accessed July 9, 2025, https://gs.statcounter.com/vendor-market-share/mobile/russian-federation

Mobile Operating System Market Share Russian Federation | Statcounter Global Stats, accessed July 9, 2025, https://gs.statcounter.com/os-market-share/mobile/russian-federation

Charted: How Apple Makes its $391B in Revenue - Visual Capitalist, accessed July 9, 2025, https://www.visualcapitalist.com/charted-how-apple-makes-its-391b-in-revenue/

Apple Statistics (2025) - Business of Apps, accessed July 9, 2025, https://www.businessofapps.com/data/apple-statistics/

US Electronic Components Still Turning Up in Russian Fighter Jets: Report - Newsweek, použito července 9, 2025, https://www.newsweek.com/russian-fighter-jets-weapons-us-companies-electronic-components-2094612

Frequently asked questions concerning the “No re-export to Russia” clause and sanctions adopted following Russia's militar - Finance - European Commission, použito července 9, 2025, https://finance.ec.europa.eu/system/files/2024-02/faqs-sanctions-russia-no-re-export_en.pdf

Tablets (Russian market) - TAdviser, accessed July 9, 2025, https://tadviser.com/index.php/Article:Tablets_(Russian_market)

Apple iPad dominates with 34.6% worldwide tablet market share - MacDailyNews, accessed July 9, 2025, https://macdailynews.com/2021/11/04/apple-ipad-dominates-with-34-6-worldwide-tablet-market-share/

Laptops (Russian market) - TAdviser, accessed July 9, 2025, https://tadviser.com/index.php/Article:Laptops_(Russian_market)

Market share of personal computer vendors - Wikipedia, accessed July 9, 2025, https://en.wikipedia.org/wiki/Market_share_of_personal_computer_vendors

In Q1 2021, Apple took over 35% Market Share of the Wearables Market in Europe, more than Doubling Second Place Samsung, použito července 9, 2025, https://www.patentlyapple.com/2021/06/in-q1-2021-apple-took-over-35-market-share-of-the-wearables-market-in-europe-more-than-doubling-second-place-samsung.html

Wearable electronics (Russian market) - TAdviser, accessed July 9, 2025, https://tadviser.com/index.php/Article:Wearable_electronics_(Russian_market)